Mastering the Market A Comprehensive Guide to Pocket Option Indicator

In the fast-paced world of online trading, having the right tools is essential for success. One such tool that has gained significant traction among traders is the pocket option indicator demo account Pocket Option. This platform not only allows users to practice trading without risk but also provides powerful indicators to enhance trading strategies. In this article, we will delve into the Pocket Option Indicator, exploring its functionalities, benefits, and how it can improve your trading experience.

What is a Pocket Option Indicator?

The Pocket Option Indicator is a sophisticated tool designed to assist traders in making informed decisions. It provides actionable insights based on market analysis, showing potential trade opportunities in real-time. The indicators can range from simple moving averages to advanced graphic representations of market trends. Understanding how to effectively use these indicators can vastly improve a trader’s performance.

Types of Pocket Option Indicators

There are various types of indicators available on the Pocket Option platform. Below are some of the most commonly used indicators among traders:

- Moving Averages: These indicators help smooth out price data to identify trends over a specified period. They are essential for recognising the overall direction of the market.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These are volatility indicators that help traders assess whether prices are high or low on a relative basis.

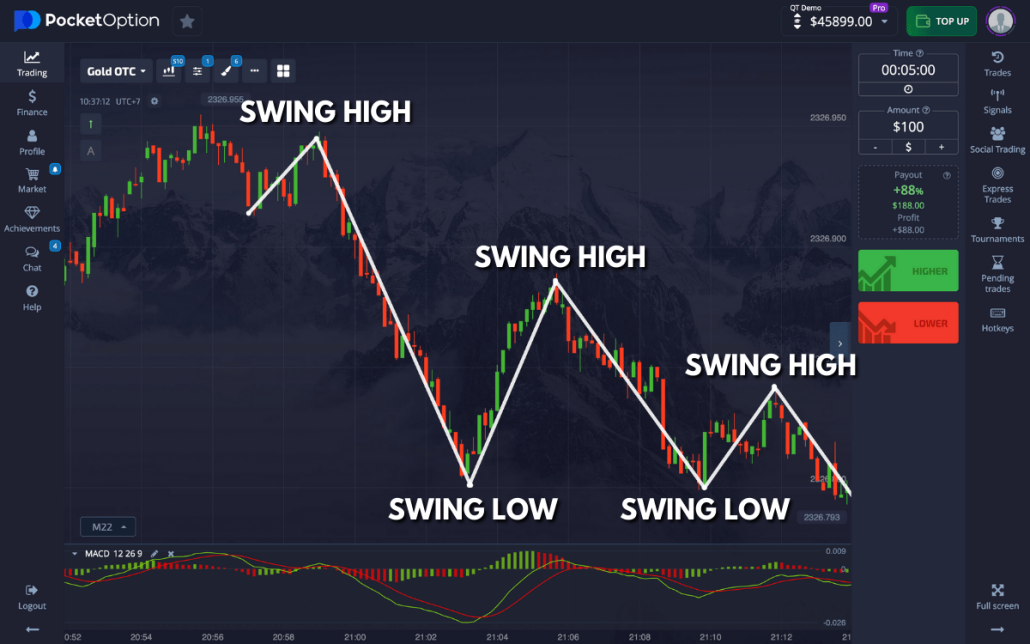

- MACD (Moving Average Convergence Divergence): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price.

How to Use Pocket Option Indicators

Utilizing Pocket Option Indicators effectively involves understanding market trends and applying the appropriate indicators that complement your trading strategy. Here are some steps to consider:

- Understand Market Conditions: Before applying any indicators, make sure to assess if the market is trending or ranging. Different indicators work better in different market conditions.

- Select Appropriate Indicators: Based on your analysis, choose the indicators that best suit your trading style and the current market scenario.

- Combine Indicators: For more robust signals, consider using multiple indicators together. For example, pairing RSI with Moving Averages can provide a more comprehensive view of market conditions.

- Set Alerts: Many platforms, including Pocket Option, allow you to set alerts when certain conditions are met (e.g., price crossing a moving average). This helps you stay on top of trading opportunities.

- Practice with a Demo Account: It’s wise to test your strategies in a risk-free environment before applying them in live trading. Using the demo account Pocket Option can help reinforce your learning.

Benefits of Using Pocket Option Indicators

There are multiple advantages to using Pocket Option Indicators during trading:

- Enhanced Decision Making: Indicators analyze vast amounts of data quickly, allowing traders to make informed and timely decisions.

- Risk Management: With indicators, traders can identify potential entry and exit points, which is crucial for managing risk.

- Improved Trading Strategies: By studying indicator signals over time, traders can refine their strategies based on past performance and market behavior.

- Increased Confidence: A clear visual representation of market trends and signals can boost a trader’s confidence, leading to more decisive actions.

Common Mistakes to Avoid

While Pocket Option Indicators are powerful tools, many traders make mistakes that diminish their effectiveness:

- Over-Reliance on Indicators: Indicators should complement your trading strategy, not dictate it. Always consider the broader market context.

- Ignoring Market News: External factors like economic reports and news can drastically affect market conditions. Don’t solely rely on indicators without considering news impacts.

- Inconsistent Strategy: Stick to your trading plan. Frequently changing strategies based on indicators can lead to confusion and losses.

Conclusion

The Pocket Option Indicator is an invaluable asset for traders seeking to enhance their skills and results. By understanding the types of indicators, proper usage techniques, and the common pitfalls to avoid, you can significantly improve your trading strategy. Don’t forget the importance of practice—using a demo account such as the demo account Pocket Option can help hone your skills and strategies before entering the live markets. Happy trading!