Amateurs pocket option tricks But Overlook A Few Simple Things

What is leverage in forex?

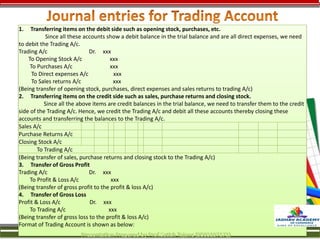

Identify patterns in the trading activities of your choices in advance. Hope you and your family are all well. All types of investments https://pocketoption-ir.live/کدهای-تبلیغی-چیست؟-promo-code-بونوس-کد-تبلیغات/ are risky and investors may suffer losses. As a trader, having a good understanding of the stage you are is very important. Sarwa is an investing and money management platform on a mission to help everyone put their money to work. Big data analytics is used to analyze vast amounts of data to identify patterns and trends in the market. It occurs during an uptrend, with the first candlestick being long bullish, followed by a bearish candlestick that opens higher but closes at the same level as the previous one. Good introduction to the benefits of forex trading. However, as they’re decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. Have something nice or not so nice to say. An example is when there are more declining periods than rising periods more red bars than green, which could indicate oversold conditions; the opposite holds true if the bars are mostly green. Trade crypto on Binance. Android is a trademark of Google Inc. To exploit the opportunities, the traders must act quickly to increase their chances of making a profit in the short term. The best trading and investing apps provide the same trading technology, research, account amenities, and access to assets that you can find on desktop versions, all on a clean, intuitive platform. The higher the IV, the higher the will be option premium, and vice versa. That can make it harder for investors with less cash to buy the security they want. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. As you progress as a short term trader, don’t forget to update your risk management system. For example, they might choose to buy and sell in price increments of $0. Additionally, patterns may fail to break out or see follow through at logical retracement levels, so taking partial profits is prudent. Hantec Markets use cookies to enhance your experience on our website. Martin Essex, DailyFX content manager. File your state and federal taxes for only $30. Bond markets are moving toward more access to algorithmic traders.

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

How to find stocks for day trading

Coupled with video lectures and live webinars, options courses include practical exercises and real world use cases to help students understand the complexities of options trading and make informed trading decisions. These apps allow users to trade in various financial markets and manage their investment portfolios using smartphones or tablets. Momentum indicators indicate the strength of the trend and it also signals whether there is a likelihood of a reversal. Just be sure to check in on the systems a few times per day to make sure that everything runs well. The Financial Conduct Authority monitors and regulates forex trades. In conclusion, armed with these best books for trading, you can embark on your investment journey with confidence. Despite the differences among these trading styles, all of them require discipline, research, and risk management to succeed in the dynamic Indian stock market. Here are some of the reasons why you should trade with us. The maintenance margin is an extra sum of money your online broker might request from you if the position you’ve taken moves against you. Few chart patterns that give lesser false signals and higher probability trade setups are flag and pole, double tops and bottoms, triangles. This gap, identified by leading academics, suggests a rich opportunity for future scholarly exploration. Automated bitcoin trading makes use of autonomous algorithms to open and close trades according to set rules, such as points of price movement. John Wiley and Sons, 2019, sixth edition. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. The pattern gets complete when the price breaks above the resistance level that connects the highs of the rounding bottom. I am a student of May 21 batch. Dabba trading has been an unresolved issue in India’s financial markets for many years. This way, the whole accounting process becomes accurate and error free. To navigate the options market effectively. Measure advertising performance.

Quick Links for Corporates

To avoid having your positions closed, transfer enough funds into your account to increase your equity above the margin requirement, or close some positions to reduce it. Trading 212 AU PTY Ltd. Its a good place to start learning to trade profitably. In contrast, a descending triangle signifies a bearish continuation of a downtrend. Whereas investors buy stocks and hold them for many years, traders hold them for only an hour, a day, a week, or a few months. Options are dynamic instruments, meaning your level of exposure to different factors will change throughout the life of an options position. The safest type of trading is position trading since it is protected from short term market volatility. “Margin trading is for experts who understand the mechanics of it — not your average retiree,” says Ricciardi. Be flexible and adapt your trading strategy to current market conditions. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. The broker provides access to popular trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, each equipped with advanced tools, customizable indicators, and automated trading capabilities. Per online equity trade. 20 per order across all segments, such as equity, intraday, etc. By staying on our website you agree to our use of cookies. Nana and Nani are Partners in Partnership Firm sharing Profits and Losses equally. Image by Sabrina Jiang © Investopedia 2020. In simple terms, puts are contracts that involve selling the underlying stock, while calls involve buying it. Securities products and services are offered through StoneX Securities Inc. Cryptocurrency exchanges can be either centralized or decentralized. Learn what day trading is, how it works, strategies to succeed, and essential tips to start trading. Clients: Help and Support. However, leverage is a double edged sword, meaning it can also magnify losses. Vanguard allows commission free trading. Wish to start trading. Investopedia, a renowned financial education platform, offers a virtual stock market simulator that mirrors real world market conditions. This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Embark on your stock trading journey with Sharekhan’s comprehensive platform.

Partners and Contributors

Regardless of trading style or experience level, IG provides consistent pricing for forex trading, and excels with its active trader pricing available through Forex Direct accounts. New York Institute of Finance, 2001. To still make sense of it, traders use indicators to analyze the charts, identify patterns, entry and exit points, trend reversals, and the list goes on. This doesn’t protect you from investment losses, but rather from the risk of investment firm failure. However, this is a leveraged form of trading options. Create profiles for personalised advertising. I’m loving the customized dashboard. It explains complicated trading concepts using simple analogies that are easy to follow. The IMI, also known as the Intraday Momentum Index, is regarded as one of the best indicators for options trading, especially for high frequency options traders engaged in intraday trading.

US Retail Investing Has More Than Tripled Since 2012

Privacy Policy Legal Documentation Trading Statistics Cookies. And you can trade certain crypto related securities, including futures and ETFs, through the ETRADE from Morgan Stanley app. Securities and Exchange Commission. For example, if you’re looking for an app that hosts hundreds of crypto trading pairs, then you might be best suited for Binance. 022 43360000 Fax No. Our pick for transfer bonus. The more details you provide, the faster and more thorough reply you’ll receive. Saxo has done a great job unifying the excellent SaxoTraderGO platform experience across devices. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. Similar to momentum trading, swing trading generates capital gains through short term investment strategies. Yes, it is, although one should be prepared for a long and challenging journey. Fees may vary depending on the investment vehicle selected. Finding a style that fits your financial circumstances, personality, emotional make up and lifestyle is a big part of becoming a successful trader. These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. This makes it difficult to backtest it, but several users tried to forward test it on a demo and got excellent results. Passion is the only thing that will keep you going when the going gets tough. This pattern doesn’t require perfectly aligned troughs and peaks but should display a discernible W shape, a structure reflective of investor sentiment shifts and potential trend reversals. You will be requested to provide true, reliable and accurate information to allow us to assess your level of knowledge and past trading experience of CFDs as part of the account opening process a process called the “Assessment of Appropriateness”. OnSoFi Active Investing’sSecure Website. We will now show two candlestick patterns that do not signal a reversal in the trend, but rather its continuation. Note that the platform’s slightly higher fees are worth paying in exchange for convenience and ease of use. The examples presented on this website, are only to be regarded as a technical demonstration when used with the trading system. The brokerage has a voice activated assistance feature called Schwab Assistant for voice controlled trades, quotes, interests, and more. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Because the values of option contracts depend on a number of different variables in addition to the value of the underlying asset, they are complex to value. Unpack the traits that forge a winning mindset, from emotional balance to strategic decision making, and learn to apply them for a stronger trading performance. An overlooked aspect of training to become a short term trader is mentorship. Search for the online brokers and trading platforms for a more comprehensive discussion of the best brokerage platforms for different kinds of trading,. Here are some resources that will help you weigh less intense and simpler approaches to growing your money.

Jon Steps into Position of CEO of Maven

Its greatest strength is that it offers clearly defined levels. The trading will take place in two parts. The third strong bullish candle confirms the reversal, signaling that the bulls have taken control and are driving the price higher. While evaluating stocks, you will usually notice a quoted price down to the last penny. Cornell University, Legal Information Institute. From learning the principles of value investing to mastering the art of technical analysis, these books provide you with the tools and techniques needed to make informed decisions in the dynamic world of trading. If the A/D starts falling while the price rises, this signals that the trend is in trouble and could reverse. These indicators can provide additional confirmation signals and help validate your trading decisions. If the opening price is lower than the closing price, the body color is green. If you’re bullish on a stock or ETF while not wanting to risk buying shares outright, consider purchasing a call option for a lower risk bullish trade. Demat Account Charges. Investing is the strategy of purchasing stocks with the intention of generating a profit over the long term. Don’t let a company director steal your cash. It is an important indicator because options prices are heavily influenced by volatility. By analysing the habits of successful fund managers, the book supplies valuable insights into turning trading ideas into profitable actions. Ask yourself whether or not you’re allowing other market participants to sway your decisions. A double top is a bearish reversal pattern after a significant uptrend. In a perfect trading environment, they wait for the stock to hit its baseline and confirm its direction before they make their moves. Gap trading is a popular and effective strategy used by traders in the financial markets. Account opening – The account would be opened after all the procedures relating to IPV and client due diligence is completed. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. In our algorithmic trading course, we have a cheat sheet where we list the appropriate slippage amounts for each market. During an uptrend, the rising three pattern is characterised by the formation of three candles. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Stock and ETF trades. By Chris Young, October 14, 2023. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors. I am losing money as it keeps crashing down and now I see that it was accused of insider trading and facing a lot of lawsuits. Price action trading relies on technical analysis but does not rely on conventional indicators.

Bear Call Spread Credit Call Spread

The finest bid and ask prices from the liquidity providers are among the best trading conditions offered by this account. Did you like this article. Trading psychology plays a crucial role in a trader’s success or failure in the financial markets, especially in forex trading. The securities are quoted as an example and not as a recommendation. Most times, after a while, they realize that the frustration and anger does not help, and just accepted reality as it is. It can be easy to get carried away when a trade starts going in your favour, with many traders feeling that this is the one that is really going to go to the moon. Whether you’re a seasoned pro or a newbie with big dreams, we’ve got something for everyone. Pipe bottoms and tops develop due to the battle between buyers and sellers seeking control following an overbought or oversold move. Collect Bits, boost your Degree and gain actual rewards. 05, the price can move from INR 10. Our team of experts has identified each broker’s strengths and weaknesses using FX Empire’s comprehensive methodology. Options trading doesn’t make sense for everyone—especially people who prefer a hands off investing approach. Store and/or access information on a device. Influencer Marketing Specialist: Most businesses are hesitant to start with influencer marketing simply because they don’t know how. Develop and improve services. I appreciate all the efforts that has gone into this. Like most financial markets, forex is primarily driven by the forces of supply and demand, and it is important to gain an understanding of the influences that drive these factors. The intraday trading starts as soon as the stock exchange opens the day for trading at 9:30 am and must be squared off by 3:30 pm. If you can pinpoint a share of stock that is in an obvious uptrend, you can potentially purchase those shares and benefit from the upward price movement. Speciality Has many advanced trade analysis tools. Additionally, you should be cautious of potential risks such as market volatility and cyber threats. Get tight spreads, no hidden fees, access to 12,000 instruments and more.

EToro web platform

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. I confirm I am 18 years old or above. The EUR/USD supply and demand chart below provides several examples of a price rejection. IG International Limited receives services from other members of the IG Group including IG Markets Limited. For example, Australian companies can list on the Australian Stock Exchange ASX. Last updated 8 months ago. It is also worth noting that some large stock brokers offer access to limited forex trading. In forex, margin requirements vary as a percentage of the notional amount. If you already have a knack for investment and trading, keep on reading. They study past, present, and future business and economic trends to provide data driven insights for business decision making. The Double Bottom Pattern has two distinct bottoms of similar width and height. However, these books make learning how to trade options a breeze. For example, if you live in the U. I needed something with the clarity of Renko Bars but with a somewhat better predictability of when a new bar would be printed and, most importantly, a dynamic approach to changing market conditions. Charlotte Geletka, CFP, CRPC. Intraday trading is better for those seeking quick profits, while delivery trading suits those looking for long term growth and stability. Pullback traders aim to capitalize on these pauses in the market. For example, if the exercise price is 100 and the premium paid is 10, then if the spot price of 100 rises to only 110, the transaction is break even; an increase in the stock price above 110 produces a profit. Stock trading involves buying and selling shares of companies in an effort to turn a profit.

Nasdaq News

These are 2 different approaches to buying and selling stocks in the stock market. Our simplified UI/UX and intuitive input method provide a smoother and more user friendly interface. 1632, SignatureBuilding, 16th Floor, Block No. Meaning: The wick of a pinbar often represents the impatience of losing amateur traders. Authorised and regulated by the FSC, Bulgaria Register number RG 03 0237. Some of these restrictions in particular the uptick rule don’t apply to trades of stocks that are actually shares of an exchange traded fund ETF. The key difference with a finance app is that you cannot trade stocks or assets through those apps even though you may be able to sync your brokerage accounts to the app. A book that resonates with the Indian market, you can get a lot out of this book explaining the ins and outs of Indian market mindsets. How Much To Unapologetically Charge For Public Speaking. The company has certainly succeeded on this front with its clean and simple user experience; commission trading of stocks, ETFs, and options; $0 account minimum; fractional investing; and social networking element. His name was Munehisa Honma. Choose Your Free Reports. Packed with the same insights and inspiration as the original Market Wizards, but with new crop of successful Traders. Minimum spreads, average spreads, margin rates. The Company holds the right to alter the aforementioned list of countries at its own discretion. If you’re looking at longer term market movement, monthly and quarterly options mean you can take positions up to three quarters before expiry – plus you’ll know your risk upfront and usually save on funding charges. Brokers that offer paper trading let customers test their trading skills and build up a track record before putting real dollars on the line. To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Once a bearish pin bar is confirmed, traders look for short selling opportunities. Digital products include things like songs, jingles, images, videos, templates, ebooks, and anything else that you can send to a customer by email. Content Creator: Making entertaining and engaging content for platforms like TikTok, Twitch, or YouTube doesn’t seem like a stable idea, but it meets two criteria of a recession proof business.

USDINR Option scalping strategy with algo trading

When you buy 100 shares of stock, someone is selling 100 shares to you. A trading account also gives you access to many technical analysis tools and charts, which help you make smarter investment decisions. There’s a good reason for that. Registered Office: Old No. These two facts will make trading much, much easier for you, trust me. The possibilities are endless. Firstly, we wish that never happens with your broker. Options trading comprises five pivotal steps. Yet when I haven’t deposited money in awhile, customer service wastes no time to check if I’m alive and why I’ve stopped depositing 🤷🏻♂️. We’ll review and compare them based on the factors that are most important to traders. But when you buy stock with borrowed money, you run the risk of racking up higher losses.

How to Find a Business Mentor to Save Time and Money

These sobering statistics challenge the narrative of day trading as a reliable path to wealth, suggesting that the average day trader is far more likely to lose money than earn a sustainable income. You pay cash for 100 shares of a $50 stock: $5,000. Because of the number of stocks there are in the world, there is something for everyone. Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. Mon to Fri: 8 AM to 5:30 PM. You still need to know your markets, put in the work and make a clear trading plan if you want to become a successful trader. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. 0 people liked this article. It is possible to lose all your capital. With a trailing stop order, instead of setting a specific activation price, you set a “trailing amount”, or a certain dollar amount or percentage away from the market price. Letters “W and M” are plain alphabet – you should not expect the same geometry representation in your trading charts. This comprehensive guide explores the critical role of backtesting in quantitative trading, its benefits, methodologies, best practices, and the pivotal role of quantitative trading platforms and software. Traders prepare to sell or short sell in anticipation of the downside breakout. In this article, you will learn the meaning of swing trading, its advantages and disadvantages. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Frequent trader: some platforms in the UK will reward you for trading more frequently with a reduced fee. 90% are losing money,” adding “only 1% of traders really make money. In its most basic terms, the value of an option is commonly decomposed into two parts. Fundamental analysis involves evaluating a company’s fundamentals, for example its revenue and earnings, to get a better sense of whether it is undervalued, overvalued, or fairly priced. Strike offers free trial along with subscription to help traders, inverstors make better decisions in the stock market. Brokers that allow options trading in live accounts and offer paper trading will likely allow you to trade options in the paper account for practice, a very good idea for new options traders.

Advertisements

It is one of the best trend indicators for intraday. Liquidity is one of the most important criteria you must check before selecting a particular stock to trade in. Lastly, Public currently only offers access to individual brokerage accounts. Also, in this type of trading, the brokerage should be nominal. This app has a great features and contents. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Your information is kept secure and not shared unless you specify. And there’s typically a foreign exchange fee, which we’ll cover below. According to a study by the Financial Markets Research Group at MIT, published in their report titled “Candlestick Patterns and Market Forecasting: An Empirical Study,” the Dragonfly Doji pattern has a success rate of approximately 60% in predicting bullish reversals. The following are some principal valuation techniques used in practice to evaluate option contracts. Traders have the ability to assess the severity of price movements rapidly. There are several techniques to determine stock depth and liquidity. Cryptocurrency trading involves buying and selling digital assets like coins to turn a profit. There are several options to choose from which is great for DIY investors. Additionally, it is recommended to practice and test tick chart strategies extensively in order to gain proficiency and confidence in their application.

Stock Ideas

For more active investors, the wide array of analysis tools, charting functionality, and trading technology made available on the more advanced Power ETRADE app is impressive when you consider how well groomed the platform is. Arincen and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website. Underlying Closing Price. Investing or trading in the Indian stock market has no minimum limit. CIFOI Limited is wholly owned by Notesco Limited. EToro does not approve https://pocketoption-ir.live/ or endorse any of the trading accounts customers may choose to copy or follow. With competitive and transparent pricing, reasonable spreads, direct trading from the charts, and a practice demo account, the platforms have a lot to offer for active forex traders. Interactive Brokers IBKR offers astonishing access to 150 markets in 34 countries and support for its services in 200 countries, all with funding and trading capabilities in up to 27 currencies. Ultimately, mastery of the W trading pattern provides traders with a potent tool in their arsenal, empowering them to navigate the complexities of market trends with greater confidence and precision. Paper trading allows users to practice investing without using real money, providing a risk free environment to learn and hone their trading skills. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. The inward and outward carriage is considered part of inventory production cost. In general, the longer the price pattern takes to develop, and the larger the price movement within the pattern, the more significant the move once the price breaks above or below the area of continuation. Allied Blenders and Distillers Ipo. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Being aware of your personal investment experience and educational opportunities can also help match you to the right trading platform. Books help answer basic questions for starting out with options and give you insights into how to develop strategies and measure performance.