latest cryptocurrency news may 2025

Latest cryptocurrency news may 2025

For 2025, Kaspa’s price is expected to fluctuate between $0.089 and $0.19, with a stretched target of $0.25. Investor sentiment and potential partnerships in Kaspa’s ecosystem, combined with institutional interest, may push price towards its stretched target https://alvenaandduaderma.com/.

How much it costs to buy cryptocurrency depends on a number of factors, including which crypto you are buying. Many small altcoins trade for a fraction of a cent, while a single bitcoin will cost you tens of thousands of dollars. However, many brokerages and exchanges now allow fractional trading, offering investors the option to buy a portion of a cryptocurrency.

TRON was founded in 2017, and TRX was initially valued at $0.0019 per token. At its peak in 2018, TRX spiked as high as $0.2245, for a gain of 11,715% in a matter of months. TRX is currently valued around $0.24.

Cryptocurrency market analysis february 2025

The Bank of England’s current rate stands at 4.75%, which mainstream analysts consider overly restrictive. The Monetary Policy Committee (MPC) may need to accelerate its rate-cutting cycle to prevent prolonged economic stagnation. Market consensus expects a 25 basis point cut at this meeting.

For crypto markets, while increased foreign capital flows can strengthen the dollar and potentially pressure risk assets short-term, the current downtrend in foreign purchases suggests rising risk appetite. This shift away from low-risk securities could benefit crypto markets, particularly as assets like Bitcoin gain recognition as digital safe havens.

Following January’s turbulence, February appears relatively quiet in terms of major financial events. However, Bitcoin has historically performed exceptionally well in February, with a strong tendency toward upward movement. Could this relatively quiet February present an opportunity for the market to build wealth under the radar?

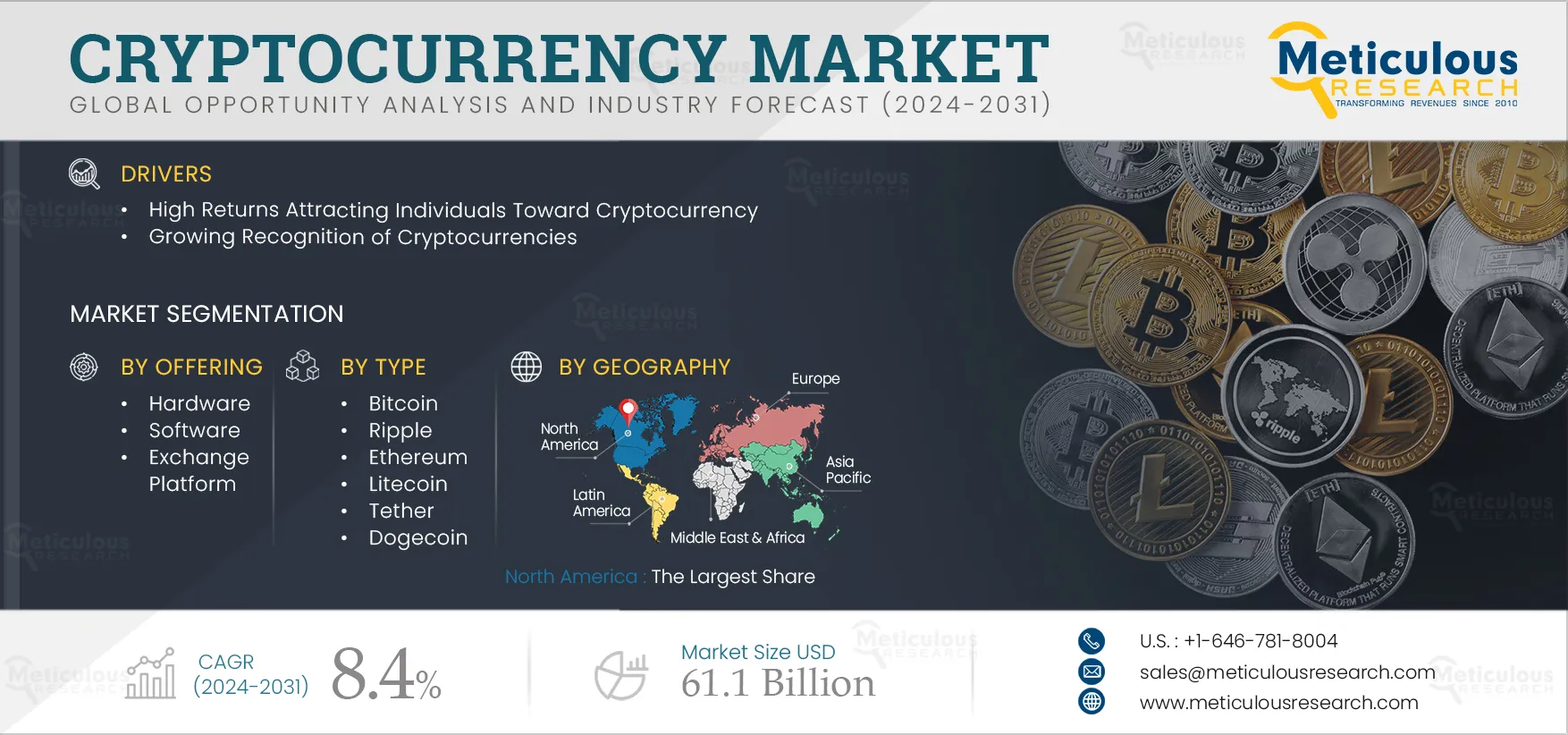

Considering the current trends and challenges, the cryptocurrency market is likely to witness continued growth in select sectors like Bitcoin and tokenized assets, albeit with enhanced scrutiny and regulatory frameworks to address transparency and risk management issues.

However, with the next Fed meeting not scheduled until March 18 and another NFP report due in between, market impact should be limited barring any major surprises, likely resulting in only short-term volatility.

Bitcoin’s robust performance amidst a broader market downturn not only highlights its resilience but also its growing acceptance in centralized finance circles. The role of Bitcoin ETFs, which saw $40 billion in inflows, cannot be understated as they significantly bolster Bitcoin’s legitimacy and appeal to new investors.

Cryptocurrency market developments 2025

This piece was originally sent to Galaxy clients and counterparties on December 27, 2024. Cryptocurrency and Bitcoin predictions were compiled by members of the Galaxy Research team between December 16 and December 27, 2024.

Lending protocols are reaching all-time highs in total value locked (TVL), and decentralized exchanges (DEXs) are capturing a larger share of trading volumes compared to centralized exchanges (CEXs). Innovative applications such as decentralized physical infrastructure (DePIN) and prediction markets are utilizing DeFi primitives to create unique user experiences.

NFTs are still a significant aspect of the crypto space and are continuously evolving by incorporating features in other sectors like arts, gaming, and many more. By 2025, NFTs can be even more deeply embedded into the different industries of the economy with new opportunities for monetization of the content and interaction with customers.

As cryptocurrency development trends progress, blockchain networks still face issues with elevated transaction costs and sluggish processing rates. These challenges restrict the scalability of decentralized applications (dApps), DeFi platforms, and regular crypto transactions. 2025 crypto trends suggest that Layer-2 scaling solutions will be crucial for overcoming these problems, facilitating quicker and more affordable transactions while preserving security and decentralization.

The common narrative is that cryptocurrency ownership skews young. And that’s largely true. About half of Millennials and Gen Z respondents globally said they either currently own crypto or have in the past, at 52% and 48%, respectively. That’s significantly higher than the general global population, at 35%.