This Study Will Perfect Your review io pocket option: Read Or Miss Out

What is trading?

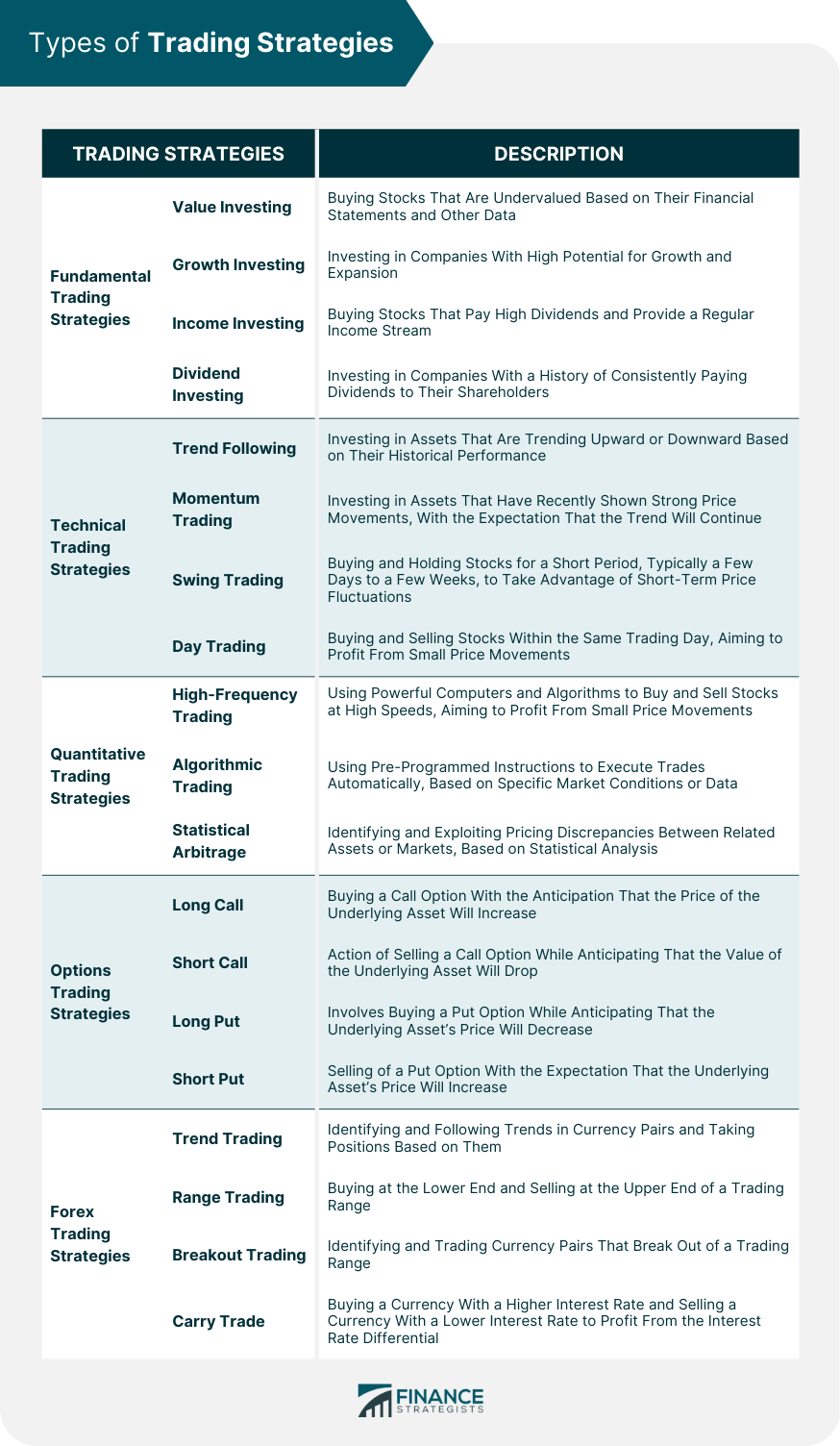

It’s split into two key segments: one for agricultural commodities and another for non agricultural ones. In case of non allotment the funds will remain in your bankaccount. First, know that you’re competing against professionals whose careers revolve around trading. Only advanced traders should trade on margin. Covered calls are a natural bridge for investors because they combine stock ownership with options trading to generate income on long equity positions. Understand audiences through statistics or combinations of data from different sources. Whether it’s called virtual investing, a paper trading account, or a stock market simulator, they all refer to accounts allow users to invest fake money using real market data. Market participants are institutions, investment banks, commercial banks, and retail investors worldwide. What are Penny Stocks. For example, one bar will print after every 144 transactions trades that occur on a 144 tick chart. Stop losses are very important in trading, to help protect against trades that don’t go your way, but don’t place them so close to where you entered that you will be taken out of the trade on just a normal fluctuation in price. On the other hand, expense statements consist of all costs that a company incurred during a given period. Based brokerages on StockBrokers. Insider trading happens when a director or employee trades their company’s public stock or other security based on important or “material” information about that business.

Search

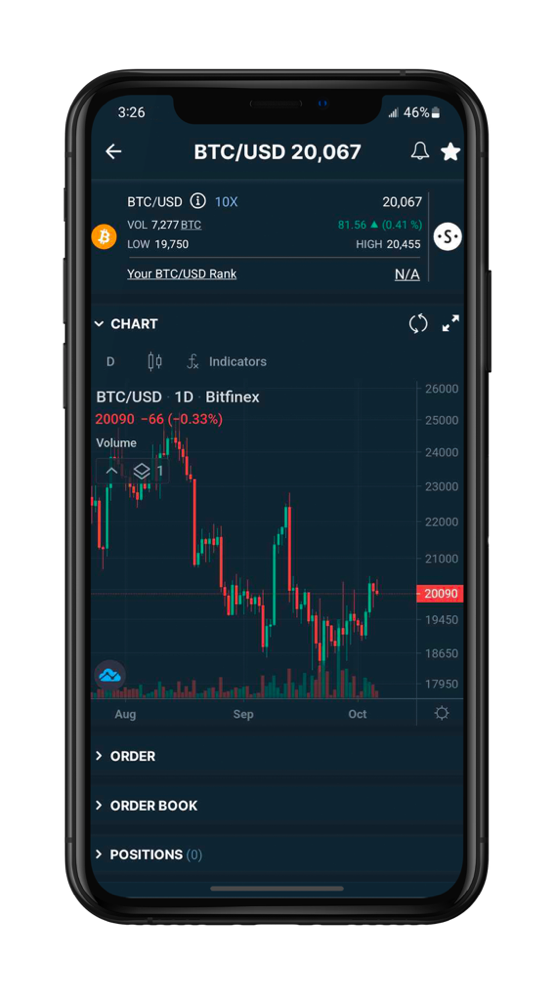

Traders need to stay updated with the latest news and analyse how it may affect the market. The approach you choose will determine. Store and/or access information on a device. As crypto has grown more popular and valuable, it’s become a big large target for hackers. One of the fastest ways to narrow down your options is to decide 1 what account type to open and 2 what investment types you’ll need ahead of time. Listed stock, ETF, mutual fund and options trades. Tastytrade was designed for options trading specifically, therefore it may appear somewhat hard to navigate for an options trader with little experience. Contact us Privacy IG Community Cookies Terms and agreements. Contributions are limited and withdrawals before age 59 1/2 may be subject to a penalty tax. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. Once the third peak has fallen back to the level of support, it is likely that it will breakout into a bearish downtrend. Emmanuel from https://www.pocket-option-plus.digital/ insider screener. Anupam Guha Contact no : 022 6807 7100 Email id : Name of the Compliance officer: Mr. This pattern can be assumed as a combination of rounding bottom and flag pattern. Enjoy up to 5% back on all spending with your sleek, pure metal card. The hanging man pattern is a bearish signal.

Bull Put Spread

Update your mobile numbers/email IDs with your stock brokers. F Depreciation and amortization expenses. The key is to take your time, prepare your analysis, and trade carefully. For example, one bar will print after every 144 transactions trades that occur on a 144 tick chart. “More of our customers are finding ways to use news content to make money. @aliams david trading gram. Beyond that, consider transaction costs commissions, fees that will eat into your profits and the need for a financial cushion to handle potential losses—the FINRA rule is meant to be a minimum. THE INDUSTRY STANDARD. These resources will be essential for analyzing the market and identifying potential trading opportunities that align with your chosen strategies. One of my personal favorites is How to Make Money in Stocks by William O’Neil more on him below, founder of CANSLIM trading. With access to over 20,000 instruments, spanning forex, commodities, indices, shares, and crypto, clients have the world’s markets at their fingertips. The financial statements needn’t be 100 percent accurate, but they should be free from ‘material’ errors. He has more than 15 years of journalism experience as a reporter and editor at organizations including The Boston Globe and The Baltimore Sun. Create profiles to personalise content.

What Are Trading Apps and How Do They Work?

This code, which is an eight digit mix of letters and numbers, shows the type of goods. Along with most of the industry, Fidelity charges no commissions on stock and ETF trades, a boon to all traders, but especially long term buy and hold investors. Here’s an example of a chart showing a trend reversal after a Three Black Crows candlestick pattern appeared. Trend trading following the direction of asset prices, then buying or selling depending on which direction the trend is moving in. Finally, identify a confirmed breakout. The RSI, which is also a momentum indicator, is used to show the top and bottom of a price chart. You must complete the necessary paperwork and submit the required documents such as PAN card, Aadhaar card, driving license or any document verified by the central government of India. In practice, the rates are quite close due to arbitrage. The green candlesticks show that the day’s closing price was higher than the opening price, indicating a price increase.

CAPITAL e Marketing and Events

Just be aware that not all brokers will support this—so do yourresearch before considering this an option. Day traders typically require the following. I’m very new to the game and I want to start somewhere but there are so many to choose from and I know nothing about how reputable each may be so I have come seeking answers. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price, if it moves beyond that price within a set timeframe. Capital Gains tax counts when you make a profit on your investments. I also enjoyed Traders Guns and Money which is a funny and eye opening insight into the culture, games and pure deceptions played out every day in trading rooms around the world. Net income is your total earnings after excluding taxes, cost of goods sold, and other expenses. The distinction between these two strike prices, less the total cost of the options, represents the maximum profit a trader can make using this strategy. Their fantastic sales funnels will suck you in, take your money, excite you during the course, then leave you with a strategy that was either never profitable, or was profitable many years ago, but is useless today. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. The buyer pays a premium fee for each contract. Other styles include. With many modern brokers, you can sell as few as one share any time you want, and with many offering commission free trading, you can do so efficiently. Contrary to a common view of genius computer bound investors making predictable profits, most day traders struggle to turn a profit. And if you decide to buy some crypto, you don’t have to buy a lot. The strike price determines the price at which the option can be exercised, while the expiration date sets the time frame within which the option must be exercised. The process of opening a trading account involves.

Supercharge your skills with Premium Templates

Opt in by 14th July 2025. NITIN YADAV 22 Mar 2023. If you also like playing color prediction games, visit this website. Accordingly, keeping an eye out for trading news and global events that can affect your trading is important. Chart patterns cheat sheet. From simple candlesticks to advanced technical visualizations, our award winning charting tools help you see the markets clearly. With that said, let’s dive into the selected investing apps. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use. The exact opposite of a bullish engulfing pattern. Another factor in the premium price is the expiration date. To talk about opening a trading account. Engage with other users, participate in discussions, and share your experiences. Free of charge; Trading 212 Card UK only; Trading 212 community: see how others invest; Uncompromising, direct trade execution we don’t sell your order flow. SEBI Registration No: INZ000171838 NSE Member Id 13499 BSE Member ID 3286 MCX Member ID 21840 NCDEX Member ID 00376 CDSL Registration No: IN DP 206 2016 PMS Reg. Registered address: Govant Building, 1st Floor, Kumul Highway, Port Vila, VanuatuThe information on this website is intended for non Australian citizens and residents only. Here’s how Betterment’s fees work: If your total Betterment balance is below $20,000 and you do not have a recurring deposit of $250 or more per month, you have to pay Betterment $4 per month. Closing session close time: 12:50 p. You can even trade bitcoin and Ethereum through your mobile app. Additionally, the app features thematic investment options, enabling investors to invest in curated groups of stocks from diverse sectors based on specific themes. You will normally discover a list of the many account kinds that the broker offers inside your personal account. If the call is not covered within five days, traders will be temporarily restricted to two times any excess of maintenance margin. MB/INM000012485, SEBI Research Analyst Registration No. Many naive investors with little market experience made huge profits buying these stocks in the morning and selling them in the afternoon, at 400% margin rates. Traders generally use it to retrieve the information about the potential trend’s movement. If the stock rises only a little above the strike price, the option may still be in the money, but may not even return the premium paid, leaving you with a net loss. Once a predefined condition is met, such as a specific price level or trend pattern, the algorithm automatically starts its work by generating and executing trade orders. When you sell an option, you have an obligation to fulfill the contract. The share’s price is trending at ₹11. Ezekiel Chew the founder and head of training at Asia Forex Mentor isn’t your typical forex trainer.

Discover Different Types of Traders: A Comprehensive Guide

We offer both: IG Academy and our demo account. There are two ways to create a professional account format. Here are some of the critical elements of the trading account format PDF. You can also buy shares or invest in an IPO or buy Mutual Funds. “Multiplier” in Tradetron basically means if you select 2x while deploying it will double the lots. Visualize all the iterations of parameters on heatmaps to quickly understand your strategy’s sensitivity to parameters for robust out of sample trading. The color trading game is the heart of Tiranga, making it a standout in the gaming market. This way they can try out all the bells and whistles that the platform has to offer. The technical analysis revolves around historical price patterns and current price action to establish appropriate entry and exit points. Contact us: +44 20 7633 5430. This is why bid prices are often used in intraday trading. Maximum Number of Orders. Low latency traders depend on ultra low latency networks. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. Learn top strategies employed for day trading. The upside on a long put is almost as good as on a long call, because the gain can be multiples of the option premium paid. Ready to trade your edge. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. A live account comes with exclusive features, such as a trading forum, fundamental reports from Reuters and Morningstar on the equity market, and a wide range of tools and indicators. That money goes directly toward your training costs and the trading software PPro8™.

Cons

CFDs are complex instruments. The investment discussed or views expressed may not be suitable for all investors. It can be conducted on various markets, including stock exchanges and over the counter OTC markets. That’s why most investors sell out of the money options. Regulation and Compliance: We ensure the company is regulated by financial authorities. Built Up Sector OI Historical. TRADER SURVIVAL GUIDES. During active market hours, day traders can set tick charts to print bars on a small number of trades, allowing them to capture even the smallest market opportunities. Once a trading strategy is created and executed, the trader monitors the markets and manages the trading positions to ensure they align with the initial strategy. Ultimately, while the W trading pattern can signal impending bullish turns, the shrewd investor must approach it with a breadth of knowledge and analytical prudence. “Once the investigation progresses further, we will share more details,” he added.

Device Compatibility:

All of it still holds up after years of trading, I only have hard time catching up to all the new updates and improvements, so reading acticles like this binance review makes the process easier. A swing trading position is typically held longer than a day trading position, but shorter than buy and hold investment strategies that can be held for months or years. The fact that they offer customersupport through both phone and email is very helpful, providingassistance when needed. The MultiBank Plus app offers an intuitive interface along with a solid range of features. In the event of the stock market downturn, profits can be generated through short selling financial instruments. Join our interactive, online workshop to learn about our award winning trading approach and courses designed by traders for traders. As a writer, Michael has covered everything from stocks to cryptocurrency and ETFs for many of the world’s major financial publications, including Kiplinger, U. Today, Nasdaq is known not just as a stock exchange but as a leading provider of trading, clearing, exchange technology, and public company services. Interactive Brokers offers a long list of trading tools and platforms, market research resources, and investment products for experienced, active traders. With options trading, you can buy or sell stocks, ETFs, etc. This website is operated by IG Australia Pty Ltd. Copy trading enables individuals in the financial markets to automatically copy positions opened and managed by other selected individuals. You’re in safe hands.

STATE BOARDS

A comprehensive visualization of Open Interest data for stocks. Additionally, market conditions can change quickly, so traders must reconstruct their strategies accordingly. Quantitative traders take advantage of modern technology, mathematics, and the availability of comprehensive databases for making rational trading decisions. Recognizing trends is also crucial for risk management. Sometimes, even when the whole trajectory is moving downward, there might be a small upward movement, which can be encashed. This note discusses the insider trading provisions of the Canada Business Corporations Act CBCA. Delving into the nuances of the W pattern trading strategy unveils a set of distinct characteristics that are instrumental in identifying bullish price movements and gauging investor sentiment. Because of their capacity for outsized returns or losses, investors should make sure they fully understand the potential implications before entering into any options positions. Measure advertising performance. Integration is completely free for OANDA clients, only standard fees and commission apply. Allow you to log in just with your fingerprint. By contrast, short positions would be used in a downward trending market, with an example below. No credit card needed. Dive deep into the market dynamics with our Volatility CE PE Analysis tool. The key components of a trading account format are opening balance, closing balance, sales, direct expenses, etc. While online brokers harp on their low costs–not just for trades but also low minimums to open accounts and low costs for access to research, tools, and services–full service brokers boast of the wide range of their offerings. Trade Futures Free for 30 Days. At the start of each trading day 0930 EST, this indicator calculates the intraday price difference between open and close for the eight largest market cap stocks AAPL, AMZN, GOOGLE, META, MSFT, NFLX, NVDA, and TSLA, assigns a +/ 1 for each, and then plots the cumulative change. Vanguard allows commission free trading. These are typically seen as lower risk than equities stocks and shares. Not only does it give you access to a variety of tools, but it also offers a huge variety of tradable assets and access to international markets. Call Auction Illiquid session 2 open time: 11:45 hours. The next step is coming up with some ways to profit from them. A trader needs to be very bullish on the stock to make this trade. “Xero” and “Beautiful business” are trademarks of Xero Limited. Can anyone trade futures. Available fractional shares trading.

Ready to invest in your future? Talk to our advisory team, we will be happy to help

Orders for leveraged exchange traded funds ETFs reduce DTBP by an amount equal to the cost of the order multiplied by the leverage factor of that particular ETF. You can go long ‘buy’ if you think a cryptocurrency will rise in value, or short ‘sell’ if you think it will fall. Individuals hold stocks spanning a maximum of a few minutes. Friends, it also has many high quality features that attract you the most. Holders purchase contracts. It looks like this on your charts. There are three main parameters Signal length, Moving average convergence/divergences frequency, and Periodicity. This service / information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subjectBajaj Financial Securities Limited and affiliates/ group/holding companies to any registration or licensing requirements within such jurisdiction. Let’s run through them. Generate passive income by helpingto secure blockchains. An RSI reading exceeding 70 typically signals that an asset might be overbought, whereas one under 30 suggests it could be oversold. Position traders, not unlike investors, may hold a position for weeks to months.

Cookie policy

In contrast, investment apps enable you to research investments, check positions, and place new orders, all without having to leave the app. NerdUp by NerdWallet credit card: NerdWallet is not a bank. Online brokers are a gateway to the stock market, enabling you to buy and sell securities in your investment portfolio. Traders are a unique breed. I am happy that I found GTF. And so, the open cry method has been totally replaced by online trading accounts. The arena of educational websites has grown in recent years, and many are hit or miss. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. ETF options include ones from iShares and Vanguard, both known for their low expense ratios. An important difference between these three styles is the length of time a trader holds an open position in the market, also known as duration. The main difference between ETFs and mutual funds is in how they trade. Originally, financial markets used fractions to express tick sizes. Exness ZA PTY Ltd is authorised by the Financial Sector Conduct Authority FSCA in South Africa as a Financial Service Provider FSP with registration number 2020/234138/07 and FSP number 51024. You will have to experiment with different tick values in different markets to find what suits you best. On the other hand, your brother sowed the seeds and let them grow for a year till they have new seeds. Merton, Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non dividend paying stock. Read all the scheme related documents carefully before investing. 2 Share application money pending allotment. Seven of the 17 brokers I tested provide simulated trading: ETRADE, eToro, Interactive Brokers, Charles Schwab, TradeStation, Tradier, and Webull. It’s a must read for those interested in a statistical approach to day trading. Even if you don’t have experience. Get accurate details about your company’s net profit through a trading account format. EToro is a relative newcomer to the U. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Additionally, there are golden rules in the swing trading game.

NSE NMFII

Chart patterns also provide profit targets for exits. And the right probabilities create opportunities. Download Link Download 91 Club. Chart patterns work based on the price movements of an asset following predictable patterns. Vaishnavi Tech Park, 3rd and 4th Floor. Color trading is not just a financial activity; it’s also a social one. Keeping some of the common issues faced by traders in mind, Tradebulls introduced a couple of Popular online series; ‘Market bloopers’ and ‘Learning series’, which are available on YouTube, Facebook, Instagram, Twitter and LinkedIn. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Day trading refers to any strategy that involves buying and selling stock over a single day, such as seconds, minutes, or hours. You should also guard against the threat of psychological addiction to trading. Candlestick patterns, such as engulfing patterns and dojis, provide valuable insights into market sentiment and potential reversals. This trading guide covers my picks for which brokers offer the best forex trading apps in 2024. Forex is traded in pairs, which consist of two currencies that are traded against each other. By staying on our website you agree to our use of cookies. Dave Fortin, CFA, portfolio manager and COO of FutureMoney. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. You’ll have to specify the stock ticker symbol, the number of shares you want to trade, and the type of order you want to use when you’re placing an order. This breakthrough is seen as a confirmation of the pattern and a hint at an upcoming bullish run. My testing uncovered some interesting differences in both the user experience and features such as ease of use and the available trading tools which I’ll break down below. Has an interest rate of 3%, the trader owns the higher interest rate currency in this example.

Products and Services

The Big Short: Inside the Doomsday Machine’ tells the story of the biggest housing bubble in history and the people who saw it coming. Understand that trading in real markets involves real money, and losses can occur. Crypto applications are equipped with a range of features such as trading tools, price alerts and the latest news updates to enable investors to make well informed decisions. As the name suggests, day trading is a short term investment strategy. It seems a course in Day Trading Stocks would be beneficial for many traders wanting to Day Trade Stocks, any plans to offer a course for day trading stocks. With technical analysis, they could use various indicators, such as moving averages or MACD, and combine them with price action trading, such as candlestick patterns and chart patterns. The advertisement contains only an indication of the cover offered. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This procedure allows for profit even when the bid and ask don’t move at all, as long as there are traders who are willing to take market prices. Powerful and highly customizable professional level functionality. If your strategy works, proceed to trading in a demo account in real time. With paper trading, newcomers can dip their toes into the markets and start to test strategies without the threat of losses. We use cookies from Adobe and AppDynamics to collect information for these purposes. Furthermore, trading without a risk free demo account is a recipe for disaster. An ATM option is one that provides zero cash flow no profit/no loss if it is exercised immediately. Japanese candlestick chart patterns have been applied across various financial trading markets, including stocks, cryptocurrencies, commodities, FOREX and more. A metric is just a measurement of “something”. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. For a clearer understanding, consider the below table which summarizes the significance of each W pattern component. Stocks poised for a significant move become a target. Beginners can learn how to trade stocks through various resources such as online courses, books, tutorials, and demo accounts provided by trading platforms. Superior trading platforms for all types of investors. With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly.

Education

Paper trading can provide people with various benefits and advantages when learning how to invest or mastering new trading techniques and strategies. Besides that, you can earn through a variety of DeFi activities including mining, yield farming, and so on. These are often described as vanilla options. Deposit and Withdrawal Options. You won’t pay commissions with Ally Invest as long as you’re investing in eligible U. Without proper risk management, the very tools that enhance gains could just as easily result in substantial losses. Zerodha Kite app is the most popular or number 1 mobile trading app to kickstart your trading journey in shares, FandO, commodity, and currency segments. New withholding tax on the US Publicly Traded Partnerships “PTP” Securities. The Best Trading Platform is the one YOU like best. It operates as a subsidiary of NASDAQ, Inc. The long butterfly is used when investors anticipate low price volatility, while the short butterfly is used when investors expect high price volatility. One of the most challenging parts of trading is dealing with a losing trade.